# 생각을 피우는 해외 주요 차트_20210604

Source: Blokland

It’s all relative chart. Compared to the peak in 2008, Commodity prices have a very, very long way to go still.

-> ’08년 피크와 비교했을 때 상품가격은 여전히 갈길이 매우매우 멉니다.

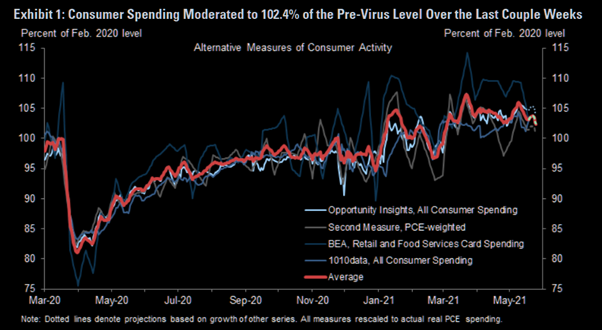

Source: Opportunity Insight

The US consumer spending tracker has declined only moderately since surging following the March stimulus checks and now stands at 102.4% of the pre-virus level. Activity in some virus-sensitive services, like air transportation, has improved sharply over the last few months.

-> 항공 운송과 같이 바이러스에 민감한 서비스 활동이 지난 몇 달 동안 급격히 개선되고 있다.

Source: JPM

Next interim stop 4348. Technician Magician at JPM: “The consolidation also played out above anticipated support that surrounds the 4000 level. We are looking for the S&P 500 Index to make further upside progress into the summer. On the upside, next resistance rests at the 4282 1Q21 pattern objective, 4315 late-May range measured move objective, and 4348 4Q20 channel trend line. At minimum, we expect the index to extend into the lower end of those targets this summer”

-> JPM 기술적 분석가는 S&P500 지수가 여름까지 더 상승할 것으로 기대하고 있다. 다음 저항은 4,282!

Source: US Bureau of Economic Analysis

Financial position of the US consumer has significantly improved

-> 미국 소비자들의 재무 상태가 크게 개선되었다.

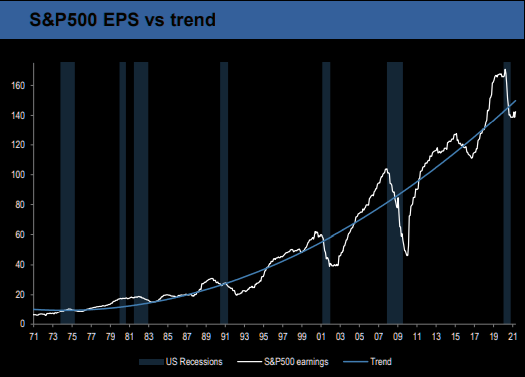

Source: IBES

US earnings at the end of April were 5% below the historical trend. Room to reflate…

-> 미국의 Earning이 역사적 추세에 5% 미달했다.

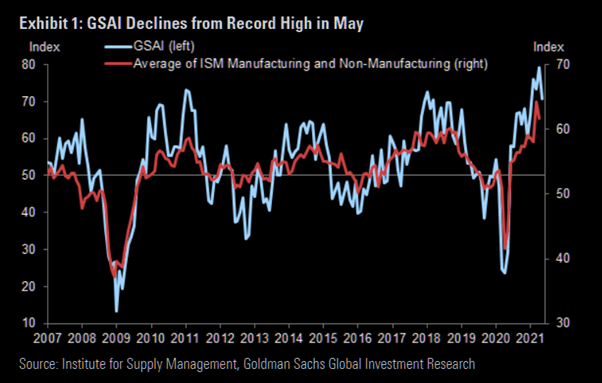

Source: GS

The Goldman Sachs Analyst Index (GSAI) declined 8.5pt from its all-time high to 70.7 in May, still a historically high level. The orders, shipments, and employment components all decreased, but also remain at fairly high levels. All in all this would fit more with the “everything is in a consolidation phase ready for the next break-out higher” rather than something for the bulls to be worried about

-> 5월 골드만삭스 애널리스트지수는 사상 최고치에서 약 8.5pt 하락한 70.7로 여전히 역사적으로 높은 수준에서 유지가 되고 있다.

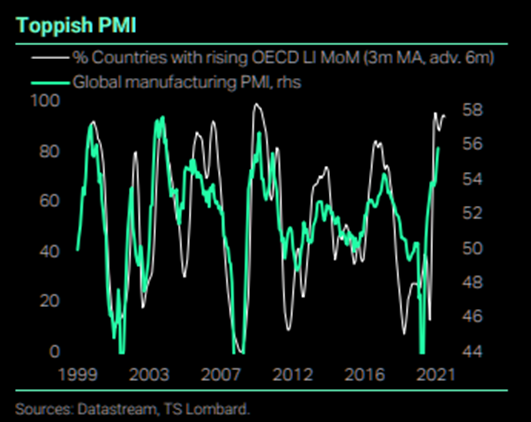

Source: TS Lombard

We got the V recovery, surging PMIs, and we are moving past the peak. TS Lombard argues we are entering the mid cycle environment where reflation remains the narrative, but at the same time growth is topping out, and where the easy gains have already been made.

-> V자 회복과 동시에 PMI가 치솟았다.

Toppish PMIs, Chinese credit impulse turning lower and Fed to taper later are all factors to watch. We have even seen some earnings revisions having started to revert lower (see our post on GS lowering GDP earlier today here).

-> PMI, 중국 신용충동 하락, Fed to taper later 등이 모두 관전 포인트!

TS Lombard expresses the mid cycle transition view by long materials vs tech and cons staples vs discretionary. The reflation trade, materials/tech (XLB/XLK), has shot up higher, but it down some from recent highs. Note it moves in tandem with the US 10 year. They conclude;

“Not only is the technology sector expensive, it is also vulnerable to negative “payback” as (1) stellar profit strength in recent quarters has, to some extent, “borrowed from future earnings” and (2) there are signs of investor “FOMO” (fear of missing out) behaviour shifting to commodities against the backdrop of rising demand for real assets.”

Source: JPM

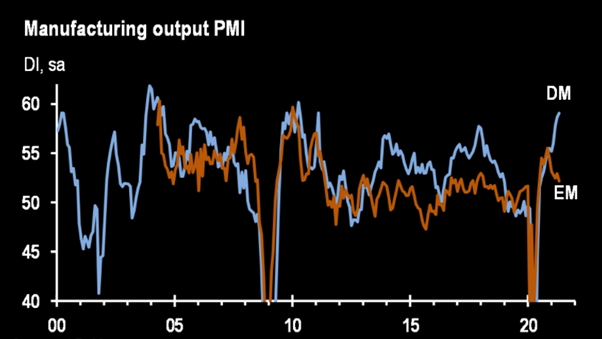

While the DM output PMI rose to 59.1, its highest level in over a decade, the EM survey moderated to 52.2. Although the DM-EM gap is now at a record high, the PMI survey points to still-solid gains in EM output. Weakness anticipated for EM this quarter is expected to be concentrated in the service sectors for those economies (e.g., India, Turkey, Brazil) most seriously weighed down by COVID-19 drags.

-> DM PMI가 59.1로 상승하면서 10년만에 최고치를 갱신했고, 이에 DM과 EM 격차가 기록적인 수준에 이르렀다.

Leave a Reply

로그인을 해야 댓글을 남길 수 있습니다.